One of the most common reasons companies go out of business is because they simply run out of cash. Construction businesses often must front much of their projects’ costs before sending out the first invoice, so they can be especially vulnerable to this if cash flow is not managed in a smart way.

That’s why effective cash flow management is so important for construction companies. Without a positive cash flow, a construction company could end up in the position where it is not be able to pay its current expenses. And so, no matter how many new projects it has lined up, it could lead to serious problems.

You can of course calculate cash-flow at different levels within a construction company. On an individual project’s basis where the cash flow deals with the income and expense on a particular project. And, an overall company cash flow which deals with the difference between the company’s total income and total expenses.

In its simplest form, cash flow on a project is calculated by subtracting cash outflows from cash inflows. You can think of cash inflows as “sources of cash” and cash outflows as “uses of cash” or “expenses”

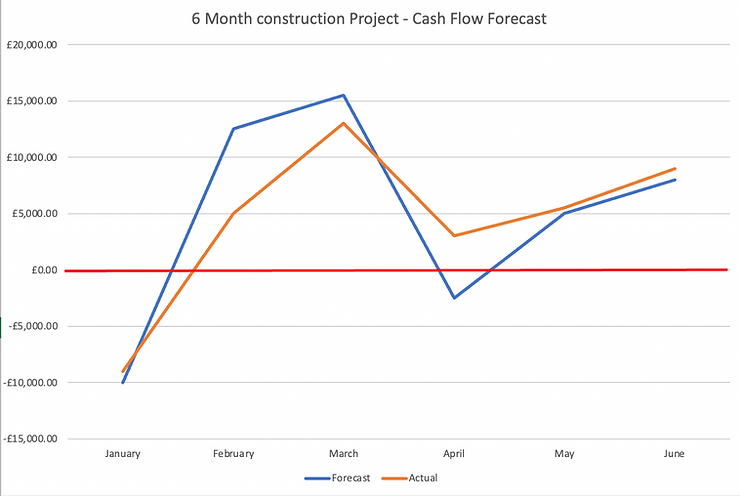

Let us take a look at what a cash flow forecast may look like on a 12-month construction project. The graph shows how the net cash position on a construction project may change over time after calculating the costs of construction to the contractor versus the amount of money the contractor has coming in, through payment of their applications and invoices. Anything above the line, when the inflow exceeds the outflow, it’s known as a cash positive position and anything below the line, when the outflows exceed the inflows, its known as a cash negative position.

So what are some of the things that could lead to bad or negative cash flow for a construction company?

1. Paying bills too early: It may seem prudent to pay bills the moment they arrive, but doing so can leave a construction business low on cash or even create negative cash flow if they do not have cash coming in.

2. No upfront payments: Construction businesses may incur many expenses before a project even begins, such as on materials and equipment. Consequently, a construction company might want to request an advance payment from the client to offset some of these expenses.

3. Slow-paying customers: A contractor’s cash flow is almost bound to take a hit when customers are slow to pay their bills. The further a company is from the top of the payment chain such as a subcontractor for example, the longer it could have to wait.

4. Not submitting applications on time: It is extremely important for contractors and subcontractors to submit their payment application on time and for it to be accurate. Failure in doing so could lead to late payment and for the wrong amount.

5. Retention: In the construction industry, it is common place for the client to withhold paying a certain percentage of the total contract value, until the project is complete, this is called retention. If a company doesn’t budget accordingly, this could lead to cash flow deficits.

6. Poor change order management: if a client changes any aspect of the original scope of work, costs or durations it can severly impact the contractors cash-flow. Without proper management, which generally falls down to the projects Quantity Surveyor, a company runs a very real risk of not getting paid everything it is owed. Similarly, the longer it takes to process a change order, the longer it takes to be paid, which can also negatively impact cash flow and the overall project’s progress.