As stated by the Royal Institution of Chartered Surveyors, “Cash flow is the lifeblood of the construction industry and relates to the incoming or outgoing of money to or from a company over a given period.” Within construction contracts, a cash flow forecast is very often used as a tool within organisations through all levels of the supply-chain and indeed by the client. To try and help inform and predict what their monetary commitments under a contract will be.

Cash flow on a project is calculated by subtracting cash outflows from cash inflows over a particular period, be that weekly, monthly, yearly or over the course of a project. You can think of cash inflows as “sources of cash” and cash outflows as “uses of cash” or “expenses”. When a construction company produces a cash flow forecast, it allows them to calculate their ‘net cash position’ at that point in time but vitally helps them to predict what their net cash position will be in the future or over the period of a project for example. Now, this is very important in the construction industry as there are generally a lot of moving parts to think about.

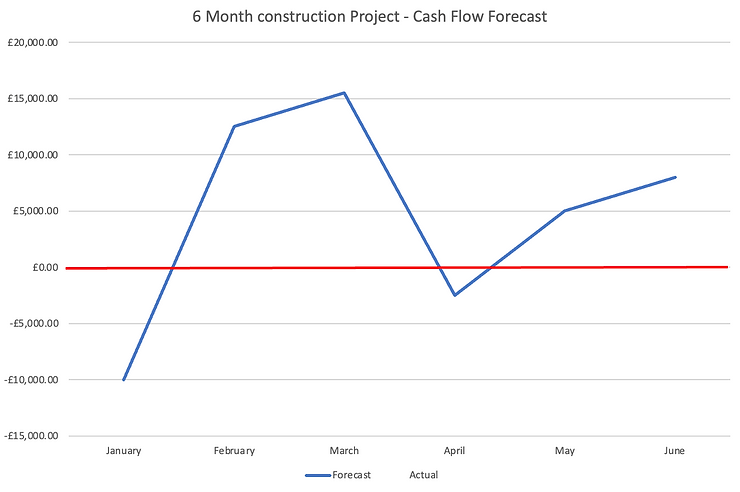

After predicting your cash inflows such as; payments of applications and investments and cash outflows such as; Subcontractors, Suppliers, staff, vehicles and Overheads each month or whatever the period may be and subtracting one from the other. You could be left with a cash flow forecast that looks something like this:

As you can see the cash flow enters a negative cash position in ‘January‘ and ‘April’ – this is caused by more cash needing to be paid out than is predicted to be paid in. Once you have a cash flow forecast in place, you have essentially mapped out your net cash position over a given period. And in doing so, it enables you to come up with a plan to improve your cash flow before it becomes reality and puts your organisation into trouble by potentially not being able pay its debts. Because if a company can’t pay its debts, it may become insolvent.

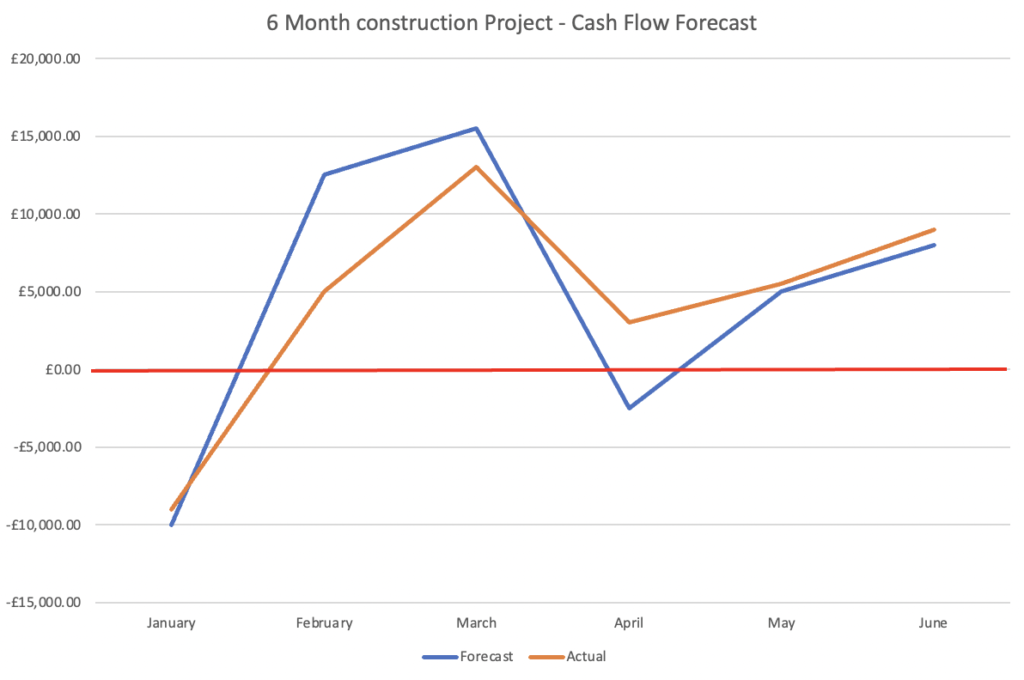

It can be useful to update the cash flow based on the actual progress and cash inflows and outflows as they occur. The actuals can be plotted on the same graph:

To present actual progress vs planned and any variation between the cash flow forecast (in blue) and actual cash flow (in orange). This sometimes helps with future analysis and lessons learned on future projects.

How to improve Cash Flow?

· Let us start with the obvious, producing effective and accurate cash flow forecasts.

· Process Change Orders quickly and efficiently. Agreeing additional works and payment is essential to keeping your cash flow positive. The longer disputes over additional work carries on for, the more likely it is to affect cash flow.

· Send out invoices as soon as possible – the sooner a client receives an invoice, the sooner payment is likely to be made.

· Shop for the best prices – due to the nature of construction projects, procuring different materials, generally in large quantities, is a huge cost. Being smart with purchases can greatly help keep a handle on cash outflows.

· Ensure your project manager understands and manages cash flow on a project effectively.

· Avoid over and under billing. Try to make your applications and invoices accurate to the works you have actually carried out.

· Decrease your payment terms but increase the payment terms of your cash outflows such as subcontractors where possible.