Interim payments are vital for construction projects which span over a long duration, as it enables on-going financing for the contractor. However, interim payments are not just a convenience for the contractor, it’s also a requirement under UK law. In this article we’re going to look at what the law says and what process needs to be followed.

So when are interim payments actually required? Let’s look at what The Housing Grants, Construction and Regeneration (HGCR) Act 1996 states:

“A party to a construction contract is entitled to payment by instalments, stage payments or other periodic payments for any work under the contract unless—

(a)it is specified in the contract that the duration of the work is to be less than 45 days, or

(b)it is agreed between the parties that the duration of the work is estimated to be less than 45 days.”

Basically, if the work is longer than 45 days, then interim payments will need to be made.

It’s important that employers are aware of this law as it provides the basis for interim payments throughout a project.

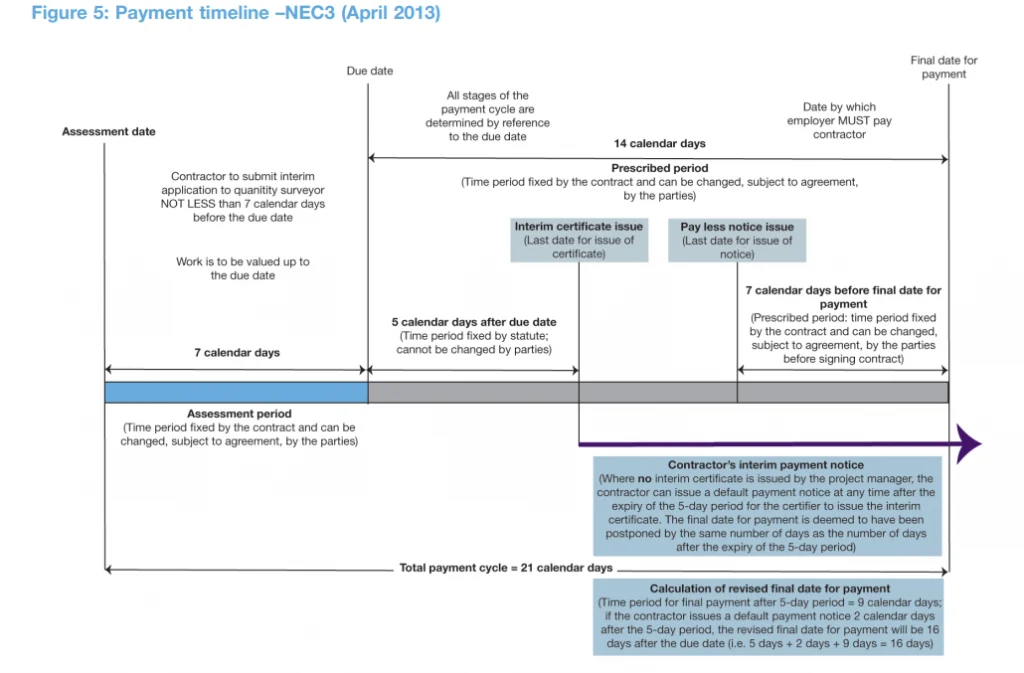

In this article we’re going to explain the interim payment process using an NEC contract. Some of the durations in this example may be slightly different for the contract you’re using. However, for the purpose of this article we will use the standard NEC 21-day payment cycle.

Under this payment cycle, the contractor submits their application for payment on the assessment date or 7 calendar days before the due date. Over the next 7 calendar days, the employer will then carry out their assessment of the contractors application taking us to the due date. From the due date the employer will have 5 days (as stated in the HGCR act) to submit their interim payment certificate to the contractor. The interim payment certificate will contain the notified sum and the final date for payment.

The final date for payment falls 14 calendar days after the due date, and if the employer intends to pay less, they must issue a payless notice no later than 7 days before the final date for payment. The final date for payment is the final date the employer can pay the contractor before the contractor can suspend performance of the contract under section 112 of the HGCRact.

It should be noted If the employer fails to provide an interim payment certificate within 5 days of the due date, the contractor’s application for payment becomes something known as a “default payment notice” under the HGCR Act. This means that unless the employer then submits a payless notice, they’ll be required to pay the notified sum under the default payment notice.

The 21 day payment calendar can be split into 2 sections: the assessment period, which covers the first 7 days, and the prescribed period, which covers the following 14 days. These periods are fixed by the contract and can be changed subject to agreement by the parties.

Why not watch our video on this topic: